Medicare Advantage: Planning for the Future

July 2024

Well Solutions Group

Part 1: The Current Landscape

The remarkable growth in Medicare Advantage enrollment over the past twelve years is raising questions about both the cost and quality of that coverage as well as the ultimate impact on health equity and solvency of the traditional Medicare program.

This is the first in a series of articles to follow, providing insight into the current landscape (both in terms of Medicare Advantage performance and growth) to help lay the foundation for steps that plan sponsors and provider organizations can be taking to prepare for the future.

Million Enrolled in Advantage Plans

%

Enrollment Decade's End

%

Spending increase per member 2024

Medicare Advantage: Where is it headed?

As of 2023, more than half of all Medicare eligible individuals (approximately 30.8 million) were enrolled in Medicare Advantage plans.

Enrollment has more than doubled since 2010 and is projected to grow to 60% of the eligible population by the end of the decade.

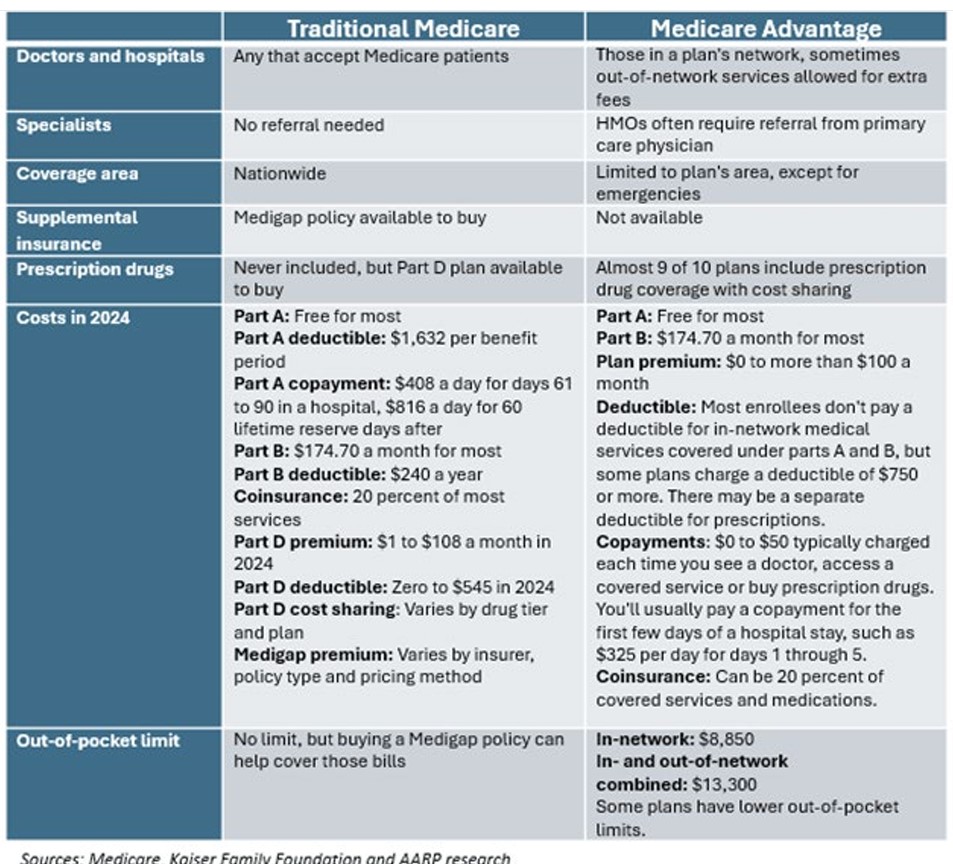

Medicare Advantage plans are offered by private insurance companies who receive payments from the federal government to provide Medicare-covered services. Medicare eligible individuals have a choice between Traditional Medicare (TM) and Medicare Advantage (MA) plans.

Reasons to Expect Continued Growth

While some of the larger MA insurers are reporting lower profits due to a relative slowdown in the rate of enrollment growth and higher than expected health care utilization/cost, there are still many reasons to expect continued interest among private insurers in growing enrollment in the years ahead, given the financial incentive embedded in Medicare’s current payment system.

Financial incentives include:

- Benchmark payments set above fee-for-service spending in the traditional Medicare program

- Quality bonuses added to total payments

- Financial benefits from residual favorable selection (after risk adjustment)

MA’s rapid growth has stirred its share of controversy. Federal government payments to MA insurers are higher and growing at a faster trajectory than spending for TM.

Medicare spends 22% more per MA enrollee

In 2024, MEDPAC estimates that the Medicare program will spend 22% more per MA enrollee ($83 billion – about $260 per person in the US) than for TM enrollees.

Despite the higher payments, analysis has failed to demonstrate fundamental differences between MA and TM beneficiary experience in terms of affordability, service utilization, and quality. Furthermore, though CMS has recently taken actions aimed at increasing transparency in MA plan performance, gaps remain that limit the ability of policymakers to conduct oversight and assess the program’s performance. (For example, MA plans are not required to report the outcome of prior authorization requests, denials, and appeals, nor details on overall claim denials.)

MA insurers should thus expect more scrutiny and additional regulatory action aimed at increasing transparency and new requirements aimed at providing justification for additional spending (MA versus TM).

Thus, now is a perfect time to take stock of the latest trends (enrollment, performance) and what they suggest for the more immediate future, so that appropriate actions can be taken to position favorably for sustained and financially viable growth.

Medicare Advantage Growth

What are some of the reasons why MA enrollment has been growing, and what does this mean for payors and provider organizations as they look to the future?

What are some of the countervailing market and socioeconomic factors that may lead to slower growth than expected, and those related considerations.

“MA insurers should thus expect more scrutiny and additional regulatory action aimed at increasing transparency.”

Why are individuals drawn to MA plans?

MA plans offer extra benefits beyond what TM provides.

- These extra benefits are funded by “rebates” – the difference between the amount that MA plans bid (estimated spending per enrollee for Medicare-covered services) and the benchmark (the maximum amount that CMS has agreed to pay per enrollee in each county). MA plans are required to use rebate dollars to reduce cost sharing and/or premiums or provide extra benefits.

- Initially these extra benefits were related to direct health care needs like hearing aids, expanded dental coverage, and other over-the-counter medical supplies. However, in 2018, CMS expanded its definition of “primary health-related” benefits to include things like home delivery of medications, transportation to medical appointments, air conditioning for individuals with asthma, and handicap grab bars in bathrooms, as a few examples.

Financial Protection

- Medicare beneficiaries are drawn to MA plans often marketed as “zero premium” plans. Like TM beneficiaries, MA enrollees are required to pay the Medicare Part B premium, but unlike TM beneficiaries, they typically do not pay a separate premium for Part D prescription drug benefits because the MA rebate dollars cover these costs.

- Beneficiaries are also keen on the annual out-of-pocket limit that Medicare Advantage plans are required to provide.

Simplicity and Convenience

- Beneficiaries are attracted to the notion of securing all coverage in one plan, obviating the need to obtain separate Medigap and Part D plans.

- Furthermore, MA plans tend to be remarkably like the “managed care” plans that many people were enrolled in prior to retirement. This was an explicit goal that CMS had relative to encouraging enrollment in MA plans – both to provide a familiar bridge to coverage upon turning 65 and to support the continued reliance on the principles of accountable care associated with managed care practices.

The growing share of large employers shifting their over 65 retirees into MA plans

- This is a strategy employed by large employers to maintain benefits, simplify administration, and lower their own costs. This shift may reduce costs for employers but also means that retirees may not have the option to choose traditional Medicare unless they are willing and/or able to set aside retiree health benefits.

- Brokers also have a financial incentive to encourage enrollment in Medicare Advantage plans because commissions are higher for MA than for Medigap and Part D plans that are purchased to complement traditional Medicare.

Switching Cost

- Risk of being denied a Medigap policy due to a pre-existing condition – MA enrollees can switch to TM during the annual open enrollment period but may not be able to purchase a Medigap policy, given limited protections for people with pre-existing conditions relative to being able to purchase a Medigap policy (only 4 states have guaranteed issue protections for Medigap).

Medicare Advantage Flexibility

This provides MA plans with a lot of flexibility both in terms of pricing and range of benefits, and competition has flourished providing people over 65 with many attractive options that can seem tailor fit’ to their individual needs.

“MA plans are required to use rebate dollars to reduce cost sharing and/or premiums or provide extra benefits.”

Let us look at trends that might inhibit MA growth:

Enrollee dissatisfaction

Additional benefits can be frustrating to use, as many of these benefits have extremely limited networks. While some plans provide excellent dental, vision, and hearing coverage, many only cover preventative services. This in fact is one of the leading reasons why individuals disenroll in MA plans.

Authorization requirements for covered services is another source of discontent.

Quality of care/stars ratings low (performance issues)

Average star ratings continue to decline and this year, about one quarter of beneficiaries are enrolled in a plan with less than four stars. The average star rating fell from 4.14 in 2023 to 4.04 in 2024. CMS established its annual star ratings for Medicare Advantage and Part D plans to measure quality of care across numerous clinical and experience metrics. Insurers earning at least 4 stars are awarded a 5% bonus.

The methodology for the ratings changed significantly in 2024. Plans are now rated on 40 unique quality and performance measures (versus 12 prior) emphasizing the importance of supporting participants throughout their care journey, with a renewed focus on health equity. Results highlight the pain points that exist across the various types and levels of care, specifically for high-risk individuals.

MA enrollment and social vulnerability are related

Counties with higher vulnerability scores show greater penetration than counties with lower scores. This calls into question, particularly given quality concerns with some MA plans – are vulnerable populations being shut out from being able to afford TM, and thus being forced to stay in MA plans that may not be performing as well? Policy makers are sure to take stock of this and plans can expect even greater scrutiny in years to come relative to these more vulnerable populations.

Transparency concerns (as raised above)

Gaps in Medicare Advantage data remain despite CMS actions to increase transparency.

Recently, CMS has clarified and expanded reporting requirements for MA insurers concerning the use of supplemental benefits available. Most MA enrollees are in plans that offer some coverage for dental, hearing, and/or vision services, as well as other “supplemental” benefits not offered via traditional Medicare. In recent years, payments to MA insurers for these benefits have increased rapidly (rising from $1,140 per enrollee in 2018 to over $2,300 per enrollee in 2024). However, there has been limited information to describe how many enrollees use these benefits, the specific items, or services they receive, or associated out-of-pocket cost.

This descriptive information will make it possible in the future to assess the extent to which benefits are being used and whether use of supplemental benefits is helping to address health disparities by filling specific social or medical needs (such as transportation to medical appointments).

Concerns regarding continued viability of traditional medicine

All this additional scrutiny comes on the heels of growing concerns about the continued viability (solvency) of Traditional Medicine and health equity relative to Traditional Medicare, given the explosive growth in MA plans and its impact on the financial performance and perceived health and socioeconomic disparities between the two programs.

It is expected that this additional scrutiny will accelerate, and MA insurers who rely on the steady and growing enrollment (and related financial benefit) pattern that exists today will need to be proactive about taking steps to shore up their performance and attractiveness of their offerings, to help sustain and fuel continued growth.

In our follow up articles on this subject, we will explore further what MA insurers can be doing to plan for the future.

Poorest Performing Measures

For example, all cause readmissions and transitions of care (inpatient to outpatient) were two of the poorest performing measures as 66% and 78% of plans received 3 stars or less, respectively. Low performing plans will be prohibited from expanding geographically and members of low performing plans will be notified by regulators and encouraged to switch plans.

New Reporting Requirements

CMS has now issued new reporting requirements for more data collection related to supplemental benefits (for the 2024 plan year). CMS is also now requiring MA insurers to post summary data on the timeliness and use of prior authorization on their own websites, beginning in 2026.